Initiation: September 5, 2019

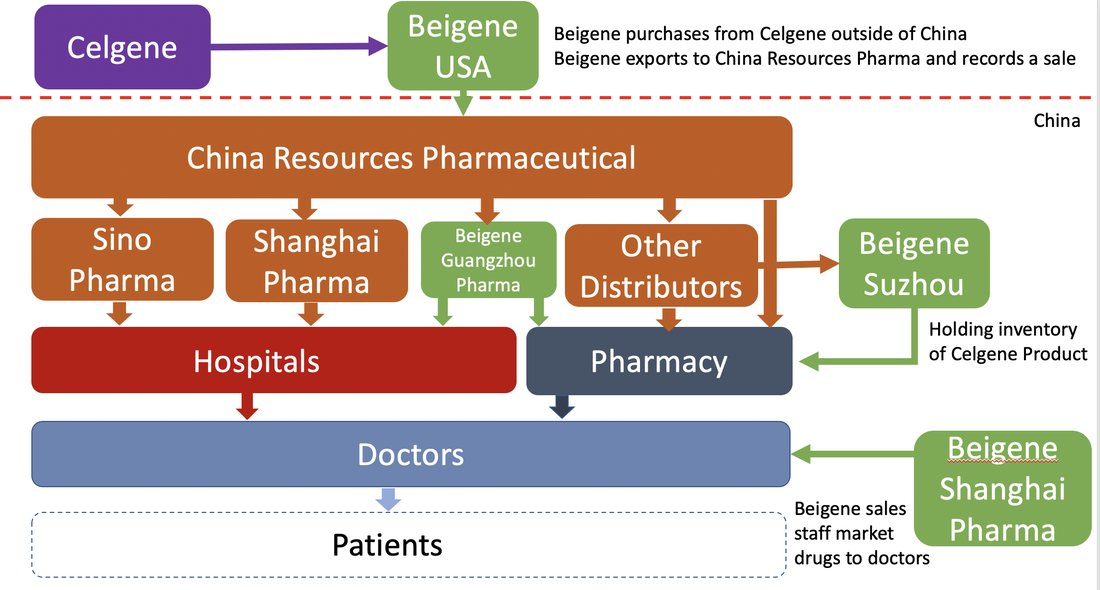

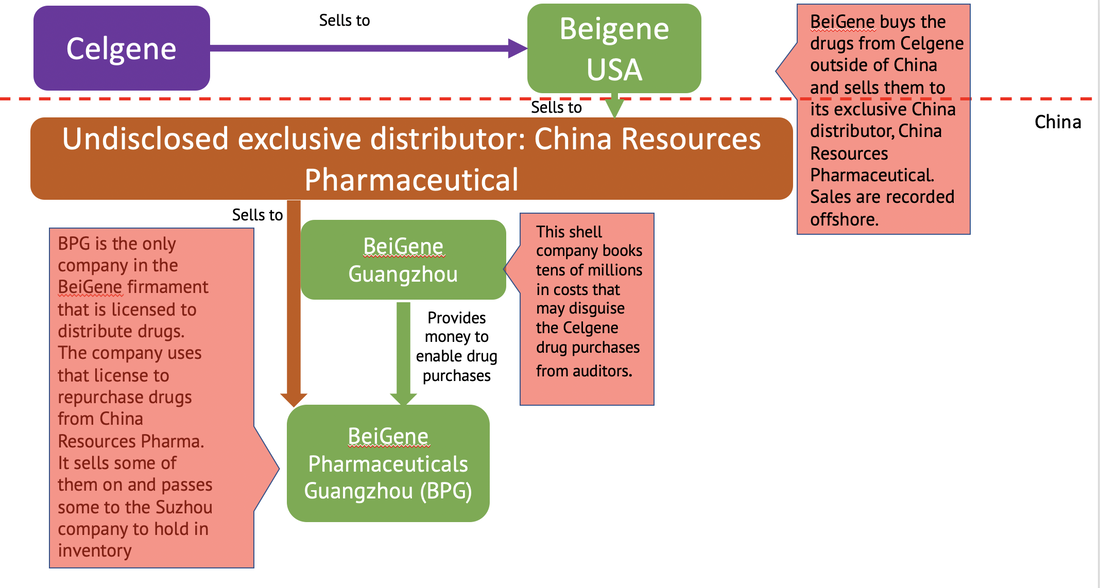

We think BeiGene has no future, and management knows it. We have clear evidence that the company is faking sales in order to persuade investors that it can develop a successful sales platform in China for pharmaceuticals; we suspect management may also be skimming R&D and capital budgets. At best, this is a poorly managed company pursuing commoditized drugs, with internal controls, even in the context of Chinese companies, that we find to be lax. At worst, BeiGene executives may be robbing shareholders.

The site of BeiGene's Guangzhou subsidiary. Photo by J Capital Research

J Capital Research ("J Cap") has analyzed the U.S.-listed company BeiGene, Ltd. (“BGNE”) and is hereby publishing the outcome and the conclusions of our analysis, based on publicly available information. We or some of our clients may be short shares of BGNE, and, for this reason, there might be a conflict of interest.

|

|