LONG TPI Composites (TPIC US)

Bladerunner

Initiation Report: December 3, 2020

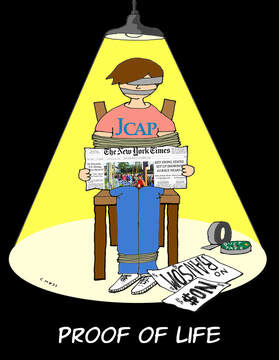

J Capital Research ("J Cap") is a stock-research company. J Cap has analyzed the U.S.-listed company TPI Composites. (“TPIC”) and is hereby publishing the outcome and the conclusions of our analysis, based on publicly available information. We may be long shares of TPIC, and, for this reason, there might be a conflict of interest.

|

We believe TPI Composites (TPIC) presents an interesting opportunity to own a business inflecting toward profitable growth with optionality on electric vehicles. In its core business, we believe TPIC may grow EBITDA by 250% over the next two years, propelled by strong demand for new wind turbines. Out beyond two years, demand for offshore wind—where the World Economic Forum predicted an 18.6% CAGR before factoring in Biden Administration programs—is likely to turbo-charge growth and profitability. While we have yet to see results from the EV business, TPIC has secured multiple contracts with automakers including Proterra and Workhorse, and, unlike many of the EV scams with little substance, possesses key EV expertise in composite manufacturing.

|

Use of J Capital Research reports is limited by the Terms of Use on its website, which can be found here. These Terms of Use govern current reports published by J Capital Research and supersede any prior Terms of Use for older reports of J Capital Research, which you may download from the J Capital Research website.

See:

Biden's energy plan IRENA report on the future of wind energy Department of Energy wind projections The Global Wind Energy Council on offshore wind The Climate 21 Project plan drafted by Obama's team and now in Biden's hands Offshore turbines. Photo by Jack Hunter, Unsplash

|