By viewing this material you agree to our Terms of Service. You represent to J Capital Research USA LLC that you are not an Australian resident. This material is not intended to be and does not constitute or contain any financial product advice as defined in the Australian Corporations Act 2001. If you are an Australian resident, please do not read this report.

Nearmap Ltd. (NEA AX)

Initiation Report: February 10, 2021

J Capital Research ("J Cap") is a stock-research company. J Cap has analyzed the Australia-listed company Nearmap Ltd. (“NEA”) and is hereby publishing the outcome and the conclusions of our analysis, based on publicly available information. We may be short shares of NEA AX and, for this reason, there might be a conflict of interest.

|

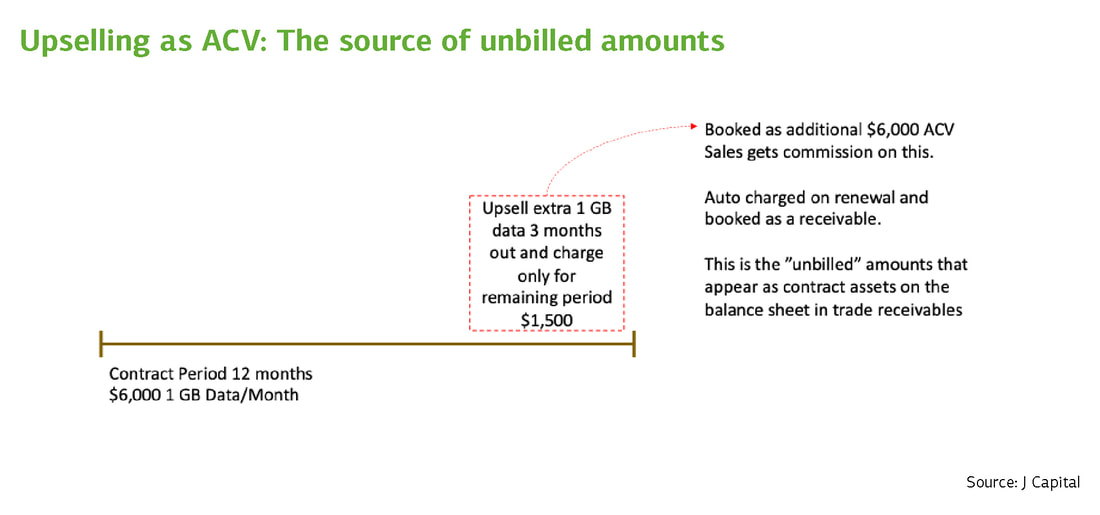

Nearmap Ltd. (NEA AX) repeatedly assures investors it deserves a heady share price because of high growth and coming profits in the U.S. market. Actually, the company is laying off sales staff and offering discounts in a panicked attempt to improve margins, kneecapping its efforts to grow. Nearmap is apparently trying to hide its U.S. failure with accounting tricks to pull forward revenue. Without that seemingly aggressive revenue recognition, we believe revenue growth in the U.S could have been half what was reported.

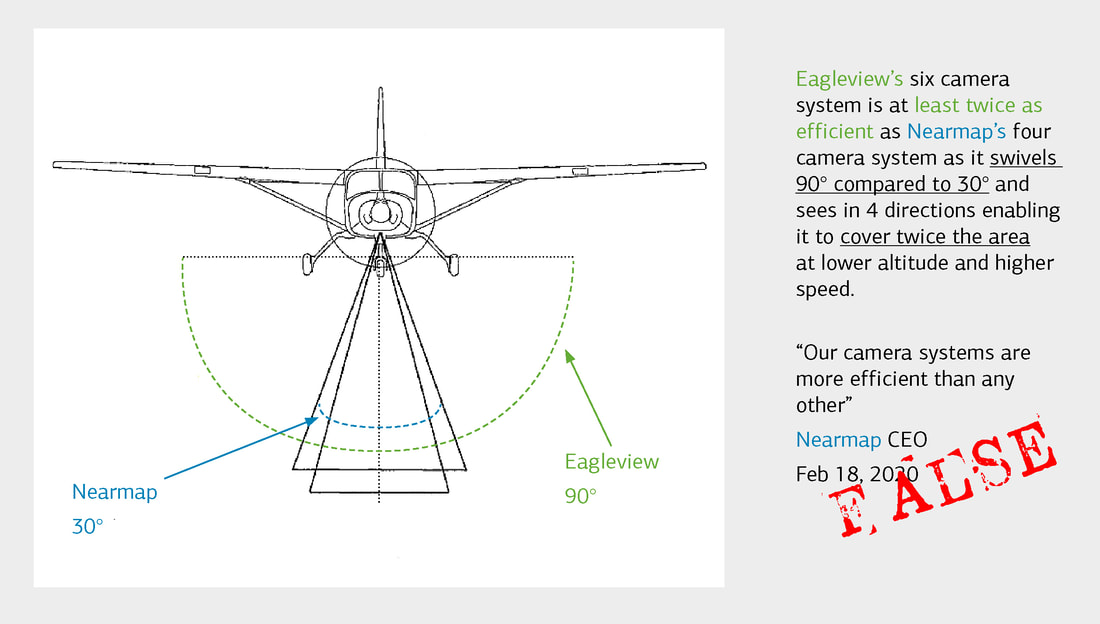

Nearmap turned up in the U.S. in 2014 with a unique product but failed to monetize it, and now competitors have speeded past. The company incurs twice the costs of the leading U.S. competitor to complete the same surveys and has a vanishingly small U.S. market share after seven years of trying. Its analytic technology lags far behind the competition. Sales to insurers, about 41% of the total, may be challenged in a potential patent dispute with key U.S. competitor. Throwing money at the problem isn’t helping. The valuation and bull case for Nearmap are based on Nearmap’s assurance that it can replicate its Australian success in the much-larger U.S. market. The reality is that losses are widening, gross margins are going backwards, and competitors are crushing them. We spoke with five competitors, seven former employees, and 17 clients or prospective clients and learned that Nearmap has failed to succeed in any key sector in the U.S. Expect more losses and more hype about the prospects in the U.S. when the company reports H1 FY 2021 on February 16. |

Use of J Capital Research reports is limited by the Terms of Use on its website, which can be found here. These Terms of Use govern current reports published by J Capital Research and supersede any prior Terms of Use for older reports of J Capital Research, which you may download from the J Capital Research website.

Resources |