ChromaDex Corporation (CDXC)

Update: The 4-Month-Old Announcement

A closer look at CDXC’s “positive” Phase 3 trial news yesterday reveals some troubling facts.

The study, conducted in Turkey, was very narrow, focused on young people without co-morbidities, whose likelihood of rapid recovery from Covid19 is high.

Furthermore, CDXC had already touted this news in a press release on February 24.

The study, conducted in Turkey, was very narrow, focused on young people without co-morbidities, whose likelihood of rapid recovery from Covid19 is high.

Furthermore, CDXC had already touted this news in a press release on February 24.

The Phase 3 trial that CDXC touted on Monday[1] was conducted at a single site in Istanbul among 304 patients with a mean age of 36 and without co-morbidities. The Phase 2 trial had been conducted with 93 patients. According to the FDA. A typical Phase 3 trial is for 300-3,000 subjects and is conducted over 1-4 years.[2]

The published study reports that it was supported by a grant from the Knut and Alice Wallenberg Foundation in Sweden and “in partnership with” CDXC.[3]

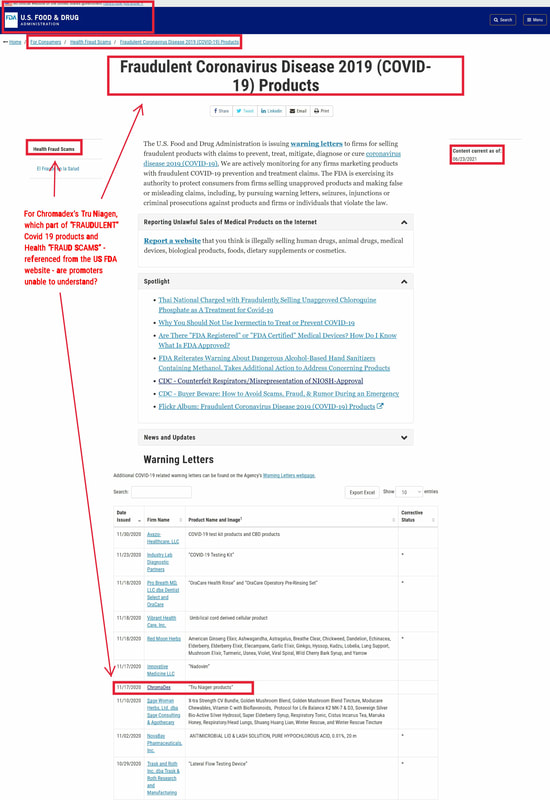

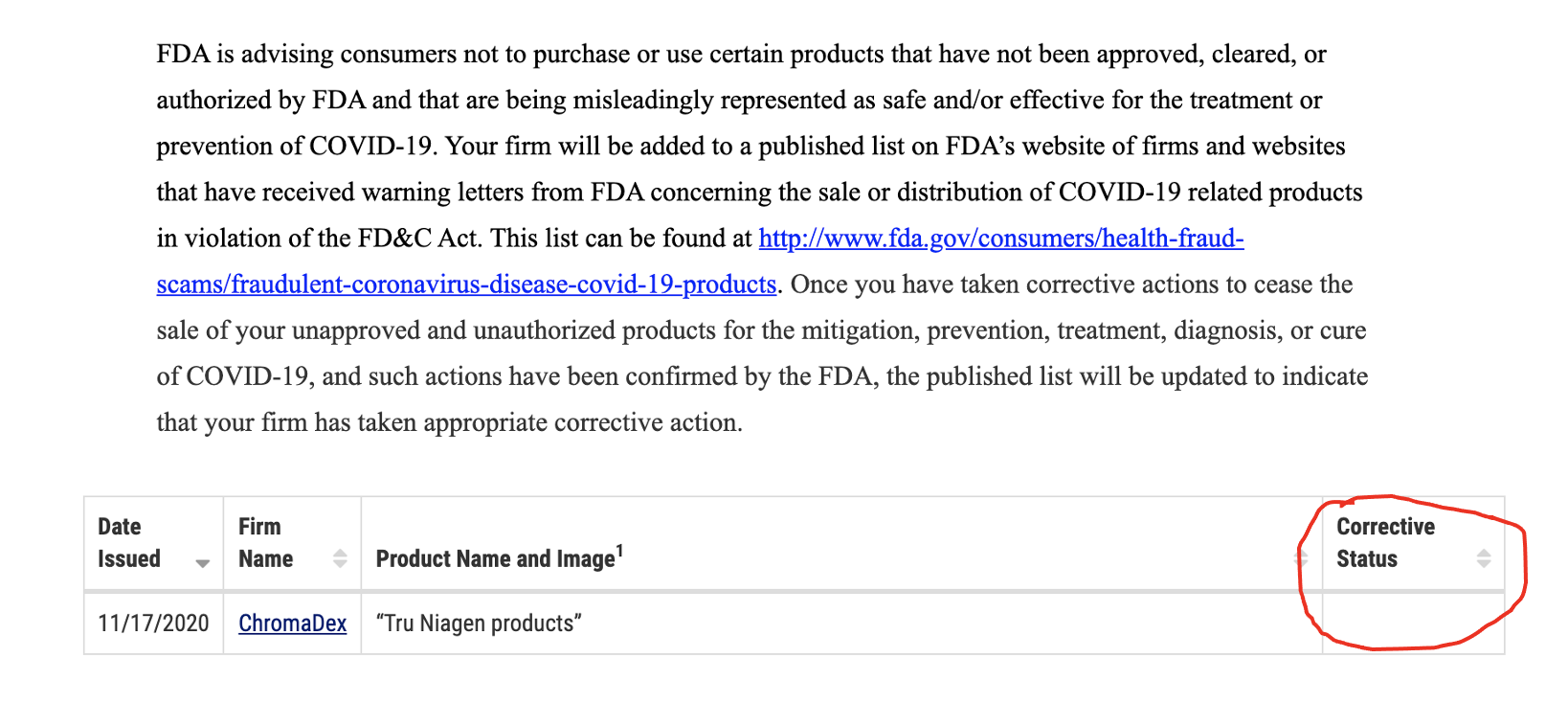

FDA and FTC violationsThe “good news” about the alleged effects of a Tru Niagen component on Covid19 could get CDXC into more hot water with the U.S. government. CDXC has already been cautioned by the Food and Drug Administration and the Federal Trade Commission in relation to promotional statements. The agencies issued warning letters in November 2020 and April 2021 instructing CDXC to stop telling the public that Tru Niagen has benefits for fighting Covid.

The November 17, 2020 letter from the FDA said:

Based on our review, these products are unapproved new drugs sold in violation of section 505(a) of the Federal Food, Drug, and Cosmetic Act (FD&C Act), 21 U.S.C. § 355(a). Furthermore, these products are misbranded drugs under section 502 of the FD&C Act, 21 U.S.C. § 352. The introduction or delivery for introduction of these products into interstate commerce is prohibited under sections 301(a) and (d) of the FD&C Act, 21 U.S.C. § 331(a) and (d). [4]

The letter went on to criticize CDXC for claiming without basis that:

Your Tru Niagen products are labeled to contain nicotinamide riboside (NR). On your websites, you claim that these products increase levels of nicotinamide adenine dinucleotide (which you abbreviate as “NAD” or “NAD+”).[5] Claims on your websites also suggest that depletion of NAD/NAD+ worsens COVID-19 and that increasing NAD/NAD+ levels—including through NR supplementation—is safe and/or effective for the treatment or prevention of COVID-19.

The FDA gave CDXC 48 hours to remove the promotional statements. Yet CDXC received another warning letter in April. The contents of this letter have not been disclosed. But the FDA told CDXC that it would update its website as soon as CDXC addressed the problem.

The website as of June 28 had not been updated.

The published study reports that it was supported by a grant from the Knut and Alice Wallenberg Foundation in Sweden and “in partnership with” CDXC.[3]

FDA and FTC violationsThe “good news” about the alleged effects of a Tru Niagen component on Covid19 could get CDXC into more hot water with the U.S. government. CDXC has already been cautioned by the Food and Drug Administration and the Federal Trade Commission in relation to promotional statements. The agencies issued warning letters in November 2020 and April 2021 instructing CDXC to stop telling the public that Tru Niagen has benefits for fighting Covid.

The November 17, 2020 letter from the FDA said:

Based on our review, these products are unapproved new drugs sold in violation of section 505(a) of the Federal Food, Drug, and Cosmetic Act (FD&C Act), 21 U.S.C. § 355(a). Furthermore, these products are misbranded drugs under section 502 of the FD&C Act, 21 U.S.C. § 352. The introduction or delivery for introduction of these products into interstate commerce is prohibited under sections 301(a) and (d) of the FD&C Act, 21 U.S.C. § 331(a) and (d). [4]

The letter went on to criticize CDXC for claiming without basis that:

Your Tru Niagen products are labeled to contain nicotinamide riboside (NR). On your websites, you claim that these products increase levels of nicotinamide adenine dinucleotide (which you abbreviate as “NAD” or “NAD+”).[5] Claims on your websites also suggest that depletion of NAD/NAD+ worsens COVID-19 and that increasing NAD/NAD+ levels—including through NR supplementation—is safe and/or effective for the treatment or prevention of COVID-19.

The FDA gave CDXC 48 hours to remove the promotional statements. Yet CDXC received another warning letter in April. The contents of this letter have not been disclosed. But the FDA told CDXC that it would update its website as soon as CDXC addressed the problem.

The website as of June 28 had not been updated.

[1] https://onlinelibrary.wiley.com/doi/10.1002/advs.202101222

[2] https://www.fda.gov/patients/drug-development-process/step-3-clinical-research

[3] https://www.kth.se/en/aktuellt/nyheter/covid-19-patients-recover-faster-with-metabolic-activator-treatment-study-shows-1.1087654

[4] https://www.fda.gov/inspections-compliance-enforcement-and-criminal-investigations/warning-letters/chromadex-607692-11172020

[2] https://www.fda.gov/patients/drug-development-process/step-3-clinical-research

[3] https://www.kth.se/en/aktuellt/nyheter/covid-19-patients-recover-faster-with-metabolic-activator-treatment-study-shows-1.1087654

[4] https://www.fda.gov/inspections-compliance-enforcement-and-criminal-investigations/warning-letters/chromadex-607692-11172020

A Full Dose of Promotion

Initiation Report: June 24, 2021

After months of examining ChromaDex (CDXC), we have come to the conclusion that this maker of a health supplement is pure hype, dished up by an Oceans 11 of stock promoters. CDXC promotes its single product, called Tru Niagen, with iterative press releases that boost share price long enough for insider sales before the vaunted advantages contained in those press releases quietly disappear.

The SEC has labeled the team behind CDXC “micro-cap fraudsters” who manipulate share prices and then “dump” the stock. These same “fraudsters” are also behind the utter wipeouts of Opko Health (OPK), MGT Capital Investments Inc. (OTC: MGTI), Cocrystal Pharma Inc. (OTC: COCP), Mabvax Therapeutics Holdings Inc. (MBVX), Pershing Gold Corp. (PGLC), Senesco Technologies Inc. (SNTI), and many more.

Key members of the team, Barry Honig, Phillip Frost, and Michael Brauser, have been targeted in a dozen lawsuits and SEC enforcement actions. Why would you trust them with CDXC?

Not only is the management team dubious, but so is the auditor. CDXC uses Marcum LLP, which the PCAOB says is riddled with deficiencies. That supervisory body has banned Marcum from conducting some audits in China—where CDXC reports substantial revenue.

The latest promote is a Walmart distribution deal, announced twice, in March and in June, for full effect. Should investors be in doubt about whether this will mean anything, a deal involving Walmart came and went in 2016, when CDXC said that a product containing Niagen would be distributed in Walmart.

The company frequently announces deals that end up producing virtually no sales. A few examples:

Virtually every distribution announcement contains more hype than substance. CDXC issued two virtually identical announcements, March 10 and June 7, announcing that the company’s single product, Tru Niagen, would be sold in about 80% of the Walmart stores in the U.S. We spoke with and visited seven Walmart stores in different states. Four carried a Tru Niagen 100 mg tablet, 30 count, for $19.97, meaning a 10-day supply at the recommended dose. Based on the slew of disappointing results from previous deals, we believe that the Walmart agreement—shamelessly announced twice—may similarly turn up empty. CDXC shares popped on both announcements, 14% on March 10 and 7% on June 7. Director Stephen Block profited from the first bump, selling 52,500 shares on March 16.

CDXC not only hypes its distribution deals—the company has been warned by the FDA and twice by the FTC to stop making claims that Tru Niagen helps combat Covid19. The first letter said: "The FDA has observed that . . . [Tru Niagen] products are intended to mitigate, prevent, treat, diagnose, or cure COVID-19." The letter called the products "unapproved new drugs" and "misbranded drugs."

After reviewing the company’s reported acquisitions and dispositions since 2012, we believe they have provided negative real value to shareholders but payoff to insiders. We will describe three of these self-serving deals in detail below. Here is a summary:

This report is opinion based upon public materials, which are referenced in links. All comments are based on such public materials unless specifically stated otherwise.

The SEC has labeled the team behind CDXC “micro-cap fraudsters” who manipulate share prices and then “dump” the stock. These same “fraudsters” are also behind the utter wipeouts of Opko Health (OPK), MGT Capital Investments Inc. (OTC: MGTI), Cocrystal Pharma Inc. (OTC: COCP), Mabvax Therapeutics Holdings Inc. (MBVX), Pershing Gold Corp. (PGLC), Senesco Technologies Inc. (SNTI), and many more.

Key members of the team, Barry Honig, Phillip Frost, and Michael Brauser, have been targeted in a dozen lawsuits and SEC enforcement actions. Why would you trust them with CDXC?

Not only is the management team dubious, but so is the auditor. CDXC uses Marcum LLP, which the PCAOB says is riddled with deficiencies. That supervisory body has banned Marcum from conducting some audits in China—where CDXC reports substantial revenue.

The latest promote is a Walmart distribution deal, announced twice, in March and in June, for full effect. Should investors be in doubt about whether this will mean anything, a deal involving Walmart came and went in 2016, when CDXC said that a product containing Niagen would be distributed in Walmart.

The company frequently announces deals that end up producing virtually no sales. A few examples:

- Nestle: The December 20, 2018 announcement of a deal with Nestle sent the CDXC share price up by 30% yet yielded just $559,000 over the following two years in licensing fees. That’s because, despite tricky wording that makes the deal sound big, it’s actually for a trivial product, an energy drink mix.

- 5Linx: CDXC announced in January 2014 that 5Linx Enterprises had agreed to buy $60 mln worth of product. Then CDXC amended the agreement to lower the minimum purchase to $1.52 mln in 2016-17.12 Given that the founder of 5Linx was later sentenced to jail for his role in the now-defunct company, we question whether the deal should have been relied upon in the first place.

- Nectar7: On October 1, 2015, CXDC disclosed that Nectar7 LLC had agreed to purchase $2 mln of Niagen in 2016 and $3 mln in each of 2017 and 2018. The agreement contained the right to cancel for any reason on 90 days’ written notice, and CDXC never mentioned Nectar7 again. We can find no evidence online of activity by Nectar7 other than the CDXC deal.

- BPI: In January 2016, CDXC said that BPI Sports would be selling Niagen-based products in Walmart and other stores. No further mention was made of the deal, and the BPI brand containing Niagen as a dietary supplement is no longer found on its own website and is “currently unavailable” on Amazon.

- GNC: On the Q1 2016 earnings call, CDXC said “In January 2016, Specialty Nutrition Group announced the release of NIAGEN in GNC stores nationwide.” Neither GNC nor Specialty Nutrition Group was ever mentioned again. We spoke with 10 GNC stores and asked them to check central inventory. None of the clerks we spoke with had ever heard of Niagen, nor did the stores sell any product branded F1rst, which Specialty Nutrition said was the Niagen brand. The website, GNC.com, has no Niagen product or any product from Specialty Nutrition. A Google search finds nothing about Specialty Nutrition since the 2016 announcement. The company has a website (http://app.specialtynutrition.com/start), but no purchases are possible.\

- CVS: CVS agreed to carry Niagen in September 2015. Web results indicate that CVS did create a Niagen product but withdrew it in early 2016. We were unable to find a reference to Niagen on the CVS website or by telephoning three CVS stores. We could not determine exactly when CVS withdrew the product, but an article on Seeking Alpha claimed it was early 2016.

- Glanbia Nutritionals: In 2012, CDXC announced a distribution agreement with Glanbia Nutritionals that was to put CDXC’s then-product pTeroPure into Walgreens and GNC. That was not mentioned again. None of the Walgreens we contacted had heard of pTeroPure or the ingredient pterostilbene.

Virtually every distribution announcement contains more hype than substance. CDXC issued two virtually identical announcements, March 10 and June 7, announcing that the company’s single product, Tru Niagen, would be sold in about 80% of the Walmart stores in the U.S. We spoke with and visited seven Walmart stores in different states. Four carried a Tru Niagen 100 mg tablet, 30 count, for $19.97, meaning a 10-day supply at the recommended dose. Based on the slew of disappointing results from previous deals, we believe that the Walmart agreement—shamelessly announced twice—may similarly turn up empty. CDXC shares popped on both announcements, 14% on March 10 and 7% on June 7. Director Stephen Block profited from the first bump, selling 52,500 shares on March 16.

CDXC not only hypes its distribution deals—the company has been warned by the FDA and twice by the FTC to stop making claims that Tru Niagen helps combat Covid19. The first letter said: "The FDA has observed that . . . [Tru Niagen] products are intended to mitigate, prevent, treat, diagnose, or cure COVID-19." The letter called the products "unapproved new drugs" and "misbranded drugs."

After reviewing the company’s reported acquisitions and dispositions since 2012, we believe they have provided negative real value to shareholders but payoff to insiders. We will describe three of these self-serving deals in detail below. Here is a summary:

- Healthspan: CDXC paid current CEO Rob Fried, then a director, about $1 mln for a company that had produced all of $20,000 in sales to that company. To make matters worse, Healthspan had existed mere weeks before CDXC signed an exclusive supply agreement with it.

- BluScience: CDXC handed some of the proceeds from selling its money-losing unit BluScience to two funds that seem to be controlled by Barry Honig. CDXC sold BluScience 13 months after establishing it. Why set it up in the first place?

- Spherix Consulting: When CDXC bought Spherix Consulting, it did not disclose that a Barry Honig vehicle and Honig’s brother were shareholders of the parent company, Spherix Inc. (now AIKI). Spherix Consulting was a poor acquisition. The unit provided no sales growth to CDXC during the six years of ownership.

This report is opinion based upon public materials, which are referenced in links. All comments are based on such public materials unless specifically stated otherwise.

J Capital Research ("J Cap") is a stock-research company. J Cap has analyzed the U.S.-listed company ChromaDex Corporation ("CDXC") and is hereby publishing the outcome and the conclusions of our analysis, based on publicly available information. We may be short shares of CDXC and, for this reason, there might be a conflict of interest.