Recently Featured

|

China Wants to Move Ahead, but Xi Jinping Is Looking to the Past, Lingling Wei, Wall Street Journal Dec 28, 2023

Interview about China on Nucleus195 Anne was interviewed on a wide-ranging set of China issues on Eurodollar University. Audio link here or video below. Illustration by David Perkins

Follow us on Forbes.com

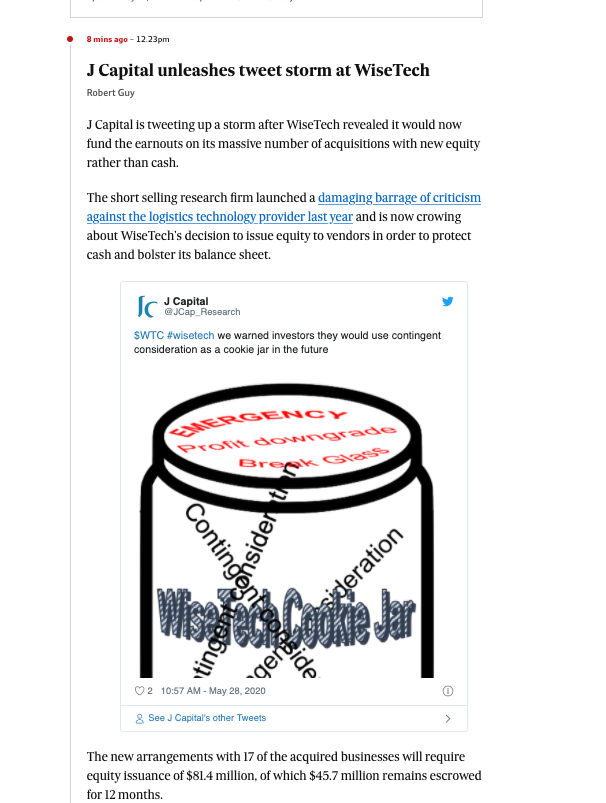

Re FFIE, on Zer0es TV On Evergrande: Quartz, The Market, The Empire's New Clothes, Real Vision, on Columbian TV On The Drill Down podcast: Is Alibaba an Enron-scale fraud? Our view on the Didi affair. In The Market July 10, 2021. On Bloomberg TV regarding China's desire to project a positive image on the 100th anniversary of the Chinese Communist Party. Bloomberg Radio chat about China's economy, its crackdown on crypto, and the friction with Taiwan and Hong Kong. Anne talks with SupChina about short selling and the China market. With the inimitable Christopher Marquis. Is a Cold War between China and the United States inevitable? Talk with Anne plus former Australian Prime Minister Kevin Rudd, Prof. Steve Tsang from SOAS, and Kaiser Kuo of Sup China, on the BBC Short selling and its discontents. On Zer0es TV Politico's China Watcher on China's dilemma facing a new U.S. administration. Anne Stevenson Yang and Tim Murray, the co-founders of equity research house J Capital, have long harboured serious doubts about Germany's embattled fintech company Wirecard, but they reached the point where they decided it was best to suspend their research efforts. June 23, 2020 Australian Financial Review On May 27, WiseTech announced that it had renegotiated earn-outs at 17 acquired companies, reducing contingent liabilities--but not reducing goodwill. J Cap's Tim Murray let out a storm of withering Twitter comment pointing out how juvenile this strategy is for creating fake profit.

Gordon Chang: "China's Economy Is In Deep Trouble," May 27, 2020. The National Interest

WiseTech (WTC AX): Told you so. February 19, 2020. The Australian Financial Review, Bloomberg The Woman at the Center of the WiseTech Maelstrom. October 26, 2019. The Australian Financial Review. How holding the line on USD rates is the most effective way to combat Chinese trade practices. August 31, 2019. Bloomberg Expectations in China trade have been raised too high. August 28, 2019. Bloomberg video Chinese iron ore imports expected to plummet in H2. March 26, 2019. Hellenic Shipping News. Why to sell Momo. December 4, 2018. Capital Watch. China expert Tim Murray says economy has reached the limits of stimulus. November 26, 2018. Australian Financial Review. Seeking Alpha podcast: what makes Alibaba tick? Hidden Forces podcast with Demetri Kofinas. Inside the Chinese Financial System. A talk with Jim Grant about Evergrande, arguably the biggest pyramid scheme in the world. "The Chinese government wants you to 'buy high, hold indefinitely,' or else," says Anne Stevenson-Yang in Barron's. |

The Chinese stock market is a "roach motel for capital,” Anne Stevenson-Yang told The New York Times.

Trump's China Strategy Isn't Working. December 30, 2018 Bloomberg. When Big Data meets Big Brother. Financial Times. In The Times, on the dependence of IP Group (IPO) in the UK on a single bet, Oxford Nanopore. "Few foreigners know China as intimately as Anne Stevenson-Yang does." Profile of Anne in Barrons. December 6, 2014. Listen to What Goes Up, the J Capital podcast.

On the Hidden Forces podcast

Way back when: the real estate doomsday scenario. Clip from 60 Minutes

Anne talks to Jim Grant about Evergrande on the ever-excellent Grant's podcast

And with Demetri Kofinas about the Chinese financial system on Hidden Forces

|

Anne on Bloomberg talking about whether the U.S. trade war could prompt a debt crisis in China.

Anne Stevenson-Yang on Real Vision.

Anne Stevenson-Yang, co-founder of J Capital Research, says China's demand for commodities is partly driven by the need for physical collateral, such as gold, to finance business. She talks to the FT's Neil Hume at Camp Alphaville in London.

In China Alone: The Emergence from and Potential Return to Isolation, Anne Stevenson-Yang argues that China historically repeats a cycle of expansion and retreat. The book is available here.

|

Anne Stevenson-Yang debates Graham Allison and Ely Ratner at the Council on Foreign Relations about whether there is a "Thucydides Trap" and whether China may fall into it.